- The Remote Life OS Newsletter

- Posts

- The Connection Newsletter 74 - The Technology Pendulum

The Connection Newsletter 74 - The Technology Pendulum

The Connection Newsletter 74 - The Technology Pendulum

Hello!

This is edition #74 of

The Connection

, the weekly email I send family, friends, and future friends (hello!) Glad you're here.

I’ve avoided television shows for the last few months.

Not that there isn’t anything good to watch. The problem is the exact opposite: there’s a ton of great television now. And my issue is once I start a good show, it’s all I think about. It’s all-consuming. A constant distraction.

I binge watch just to get the show out of my head.

For example, I turned on the BBC’s Bodyguard the night before an all-team strategy session. I started at 11:30pm, and didn’t stop until 4:30am, completing the entire mini-series in a single sitting. I didn't have a single good idea the next day (worth it).

So instead of watching the occasional TV show, I’ve switched entirely to movies. One and done, and then back to my life.

Some movies I watched (or re-watched) recently worth sharing:

Vox Lux

- Natalie Portman stars as a pop-star. Not for everyone, but I loved how the story was told, in this gritty, Marc Webb-like narrative.

Lock, Stock, and Two Smoking Barrels

-

Snatch

is the Guy Ritchie film most people remember but its predecessor is even better, in my opinion (avail on Netflix).

Good Night, and Good Luck

- A good reminder of the stakes when the media stands up to the government (avail on Netflix).

Aziz Ansari: Right Now

- Comedy special, not a film, but whatevs. Loved hearing Aziz’s perspective on the aftermath of the Babe.net story (avail on Netflix).

Eternal Sunshine of A Spotless Mind

- Masterpiece (avail on Netflix).

Blue Valentine

- One of my favorites of all time. I try to rewatch at least once a year (avail on Netflix).

The Dawn Wall

- Story of Tommy Caldwell scaling 3,000 feet of an impossibly difficult rock face. The little narrative surprises delicately scattered throughout the documentary made this one special (avail on Netflix).

Toy Story 4

- Perfectly structured and thematically sound. Each time they announced a new

Toy Story,

I'm afraid they’ll ruin the magic, but after

three sequels

I don’t think they’ve missed so much as a beat. Truly genius.

That's it! Let's get into this week's articles.

(Want less email? No problem, you can unsub at the bottom. We'll still be friends.)

Did someone forward you this email? You can subscribe here.

The Technology Pendulum

For the last 10 years, the tech pendulum swung towards the “Growth Above All” mantra. Growth was the rallying cry of Silicon Valley, and in its wake fell burnt-out employees, retail investors, and profits.

By the end of 2018, start-ups in the United States had raised a record $131 billion in venture funding, surpassing the amount collected during the late 1990s dot-com boom.

But with the lackluster performance of post-IPO technology companies (Peleton, Eventbrite, Uber) and recently failed IPOs (We Company, Endeavor, Postmates) the pendulum has comically swung the other way.

Is this the end of growth-focused companies? Unlikely -- this feels like a necessary counter-move against the last 10 years of hype. But let’s look at some of the analyses below:

Credit: Doug Chayka

The idea that venture capitalists (who are financially incentivized to push startups towards growth) are the ones sounding the alarm and prioritizing positive unit economics strikes as Alanis “rain-on-your-wedding-day” level of irony.

A profitable company is the same as a loss for many VC’s. One of the best examples of this was written by Sahil Lavingia, the founder of Gumroad.

Gumroad turned $10 million of investor capital into $178 million (and counting) for creators. And in the eyes of venture capitalists, it was a failure.

“We were venture-funded, which was like playing a game of double-or-nothing. We weren’t doubling fast enough to raise the $15M+ Series B (the second major round of funding). For the type of business we were trying to build, every month of less than 20 percent growth should have been a red flag."

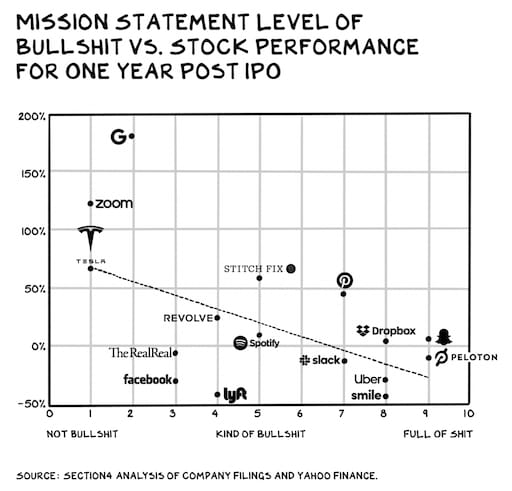

Professor Scott Galloway crushes it in this post about yogababble:

"The lengths to which technology firms will inject corporate speak and euphemisms into their S-1's, and their corresponding performance one year post-IPO."

Examples:

Company: Zoom

Mission: “To make video communications frictionless.”

This is accurate. Zoom is a video communications company. It offers less friction, as demonstrated by a higher NPS score (62) than Webex (6).

Bullsh*t rating: 1/10

Stock return 6 months post-IPO: +122%

Company: Peloton

Mission: “On the most basic level, Peloton sells happiness.”

Nope, similar to Chuck Norris, Christie Brinkley, and Tony Little, you sell exercise equipment.

Bullsh*t Rating: 9/10

Stock return 1 day post-IPO: –11%

(Scott Galloway’s book, The Four, was excellent. You can read my notes

.)

H/T Brendan M

The writer harbors no love for Ari Emanuel, Endeavor, or the banks underwriting IPOs, and his scathing analysis of the failed IPO borders gleeful.

Personal attacks aside, he explains Emanuel's rise in Hollywood and beyond succinctly, as well as the use of "adjusted EBITA" to make these investments palatable for investors:

“Basically, ‘adjusted EBITDA’ allows companies, with the considerable help of its underwriters, accountants, and the Securities and Exchange Commission, which must sign off, of course, to turn operating losses into operating profits."

(What is adjusted EBITA? Essentially, it removes irregular or one-time items from a company's Earnings Before Interest Taxes, Depreciation, and Amortization. And can turn losses into profits.

I asked a former colleague how the failed IPO will affect Endeavor agents:

"It’s terrible for the agents because many had their salaries reduced with the expectations that they were going to be made more than whole with the IPO. I would imagine that the partners will demand a larger share of the company."

Credit: Max Pepper

One more example of a company focused on growth over positive unit economics.

Growth at Wag, the dog walking startup, stalled after the founders sold their shares and became VC’s, SoftBank invested $300m, and they brought in a new CEO.

"I had very high hopes when I joined Wag. I really thought the company was going somewhere. It became apparent that the ship was sailing back to port."

Credit: David L. Ryan/The Boston Globe

Last week I worked in San Francisco, shoulder to shoulder with the rest of my colleagues who'd also flown in for the week. It was terrific fun and great for bonding.

It also cut our collective productivity in half -- even after I plugged in with headphones and blasted TayTay for 3 hours straight. You can’t stop (won’t stop) the distractions.

Farhad Manjoo breaks down this loss in productivity:

“Open offices were sold to workers as a boon to collaboration — liberated from barriers, stuffed in like sardines, people would chat more and, supposedly, come up with lots of brilliant new ideas. Yet study after study has shown open offices to foster seclusion more than innovation; in order to combat noise, the loss of privacy and the sense of being watched, people in an open office put on headphones, talk less, and feel terrible.

“WeWork’s fundamental business idea — to cram as many people as possible into swank, high-dollar office space, and then shower them with snacks and foosball-type perks so they overlook the distraction-carnival of their desks — fails office workers, too.”

H/t Akiva G

Thanks for reading!

Last thing: Is there anything I can help you with?

If there's any way I can help out, please let me know. Or if we just haven't chatted in a while, I'd love to hear from you. Just reply directly to this email.

Reply