- The Remote Life OS Newsletter

- Posts

- The Connection Newsletter 60 - I don’t wanna wait

The Connection Newsletter 60 - I don’t wanna wait

The Connection Newsletter 60 - I don’t wanna wait

Hello!

This is edition #60 of

The Connection

, the weekly email I send family, friends, and future friends (hello!) Glad you're here.

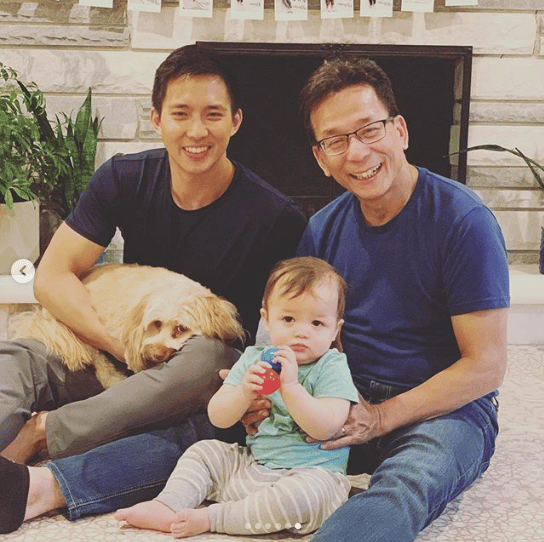

For all the dads out there - hope you had a terrific Father's Day. This was my first Father's Day as a father (to a human, not a pup). It's a bit surreal, tbh. We had a great day with some real suburban dad activities: building Ikea furniture, going to BJs to stock up on ~100 hamburgers, and barbequing steaks.

A little less time to read this week, as I’ve been busy with Reforge and carving out morning hours to learn SQL. Learning SQL definitely exercises brain muscles that have laid dormant and atrophying for a long time, and it’s nice to get them firing up again.

Hope you’re having an excellent start to your summer. Let’s jump into the articles:

Make sure to hit "Display Images" above to see puppy pics.

Barnes & Noble sold to hedge fund Elliott Management Corp last week. Amazon took half the market share for print books, and

84% for e-books. B&N has a fifth and 2%, respectively.

Here’s a little anecdote from Brad Stone’s “The Everything Store”:

“In 1996, Jeff Bezos, the 31-year-old CEO of a scrappy startup that sold books online, was approached by Riggio, the multi-millionaire boss of iconic B&N, about a collaboration. For context, Amazon had $16 million in sales in 1996, and B&N $2 billion. Riggio told Bezos that B&N would soon start its own website and crush Amazon

It would be better if they worked together.

Bezos declined.”

---

The brand that became synonymous with the ruddy-cheeked American Dream and a look book right out of a scene from

Dawson’s Creek

(#teamjoeypacey) fell to the same cultural forces that rocked mid-tier American retailers like The Gap, Banana Republic and Ann Taylor: e-commerce and fast-fashion.

These were threats that J. Crew’s promise of craftsmanship, detail, and lasting quality was not built to withstand.

(Speaking of, I just learned yesterday that

Dawson's Creek

is available to stream for free for Amazon Prime members 😍)

---

Apple announced it’s sunsetting the product. It’s hard to fathom that the bloated software used to play music and videos you actually own (what? why?) will be missed, but the nostalgia factor is real.

For millennials of a certain age, using iTunes to launder and catalog your illegally downloaded music was a weekend ritual, a rite of passage, and musical education, baked into hours spent re-naming the song, artist, and album of every mp3 on your hard drive.

---

I’ve spent many hours responding to Yelp reviews over the years, and pouring over all the 4- and 5-star reviews that for one reason or another, were relegated to the abyss and never factored into our restaurant’s overall Yelp score. Or trying to figure out why, out of the hundreds of beautiful photos we have, Yelp choose our ugliest one for our cover photo (which you can change -- for a price).

So while I think the theory that Yelp uses its algorithm to extort businesses to buy over-priced ads is a conspiracy theory, I must admit the story of a small business owner taking on the tech company warms the heart.

---

The profile of a money manager at the highest levels. It’s fascinating that there’s a demand for these services (telling the NBA super-rich how to spend their money) and that customers will pay a premium for the privilege (an administrative fee plus an adjustable percentage of assets invested). But there are conditions to become a client of Joe McLean:

To retain his services, each player must agree to put aside at least 60 percent of every dollar he earns, with the rate climbing to 80 percent if he’s fortunate enough to land a long-term deal. Or they’re gone. Mr. McLean has fired two clients for ignoring the policy. He hates it, because “in my mind it means I’m giving up on them,” he said. “But they didn’t buy into it.”

---

A mix of stand out parenting and personal finance advice from Morgan Housel. What resonated in particular:

“The highest dividend money pays is providing the ability to control your time. Being able to do what you want, when you want, where you want, with who you want, for as long as you want, provides a lasting level of happiness greater than any amount of fancy stuff can ever offer.

The thrill of having fancy stuff wears off quickly. But a career with flexible hours and a short commute will never get old. Having enough savings to give you time and options during an emergency will never get old. Being able to retire when you’re ready will never get old. The ultimate goal is independence, but independence is not black or white, all or nothing. Every dollar you save is like owning a slice of your future that might otherwise be managed by someone else, and whatever their priorities are.”

---

Justin Mares talks about how we can look at our calendar through a lens of: “how well does my calendar reflect my top priorities?”

Ramit Sethi said something similar, framed slightly differently: show me your calendar and where you spend your money and I’ll show you your priorities.

For example, if you say that your health and fitness is your top priority, but you’re not carving out time to work out or allocating money to buy healthy food, then it’s not a priority.

---

Others

Sorry for the Delayed Response. Funny because it’s true.

The NYTs open sourced their data skills for reporters program

Mary Meeker’s Internet Trends is out

Thanks for reading!

Last thing: Is there anything I can help you with?

If there's any way I can help out, please let me know. Or if we just haven't chatted in a while, I'd love to hear from you. Just reply directly to this email.

Reply